MENUMENU

KanCare is a health care program the state of Kansas offers to all Children's Health Insurance Program (CHIP) and Medicaid enrollees. Established in 2013, the program helps cover the costs of medically necessary healthcare services for pregnant women, children, people with disabilities, and residents over 65.

KanCare eligibility largely depends on income, as this program is specifically for low-income families.

Every state has its own form of Medicaid, which is a government-funded healthcare program that helps lower-income families afford the healthcare coverage they need. KanCare is Kansas's Medicaid program.

KanCare is a state and federally funded healthcare program that helps low-income families cover the costs of essential medical services. When you enroll in KanCare, you can save on medical costs, but the Kansas Medicaid system is notorious for having strict eligibility requirements. As such, it's important to understand what KanCare is, how to apply for KanCare, and what services it covers.

You can also extend coverage by partnering with a third-party insurance company to get more well-rounded coverage and lower overall medical costs. To prevent shouldering the debt of unexpected medical expenses, many Kansan residents extend their Medicaid coverage to include a more comprehensive range of benefits and services by way of private health insurance.

KanCare is a federal and state-funded medicaid program that operates in Kansas through the managed care model. Rather than the state paying health care providers directly, as with a fee-for-service plan, Kansas partners with three managed care organizations (MCOs) to give Medicaid and CHIP enrollees coverage for certain medical services. As a KanCare member, you can join one of three health plans:

One of the advantages KanCare offers is a lack of copays, which means that if you qualify for KanCare coverage, you don't have to pay out-of-pocket costs for your doctor's appointments. However, you may have to pay a monthly premium of $20 to $50, depending on your family's income level.

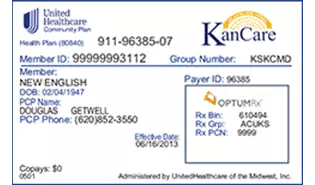

After you enroll in KanCare, you'll receive your KanCare card, which acts like a typical health insurance card. You'll show it when you go to the doctor so the staff can bill the insurance company for your medical care. On the back, you'll see your KanCare number. Essentially, your KanCare card and number are proof of your enrollment, giving you access to all KanCare coverage benefits.

Your KanCare card also has the information for the MCO you enrolled with, so keep this card somewhere safe where you can easily access it.

If you want to know how to apply for KanCare, one of the easiest and most convenient ways to begin the application process is by visiting the Medical Consumer Self-Service portal. On this website, you can check your eligibility, submit program applications, and access your KanCare account once you enroll.

You can also call KanCare Clearinghouse directly at 1-800-792-4884 to request a KanCare application and have the office send you a physical document in the mail or download your application and complete it at home.

If you opt for the paper application, you can submit it to KanCare by mail or by fax:

As part of the application process, you can choose which MCO you wish to enroll in should you receive KanCare application approval. If you have a plan provider preference, it is essential that you complete this part because KanCare will automatically assign you to a plan if you do not specify otherwise. Fortunately, you have 90 days to change your plan if you don't like the one KanCare automatically enrolls you in.

If you miss the Choice Period End Date when your 90-day period ends, you will have to wait until the Annual Open Enrollment period to change plans.

To enroll in KanCare, you must be eligible for Kansas Medicaid, which has strict eligibility requirements. First, you must be a U.S. citizen, national, or legal alien. You must also be a legal resident of Kansas and part of a low-income household.

In addition to the above qualifications, you must be pregnant, blind, 65 years or older, or have a disability. You may also be eligible if you have a child under 18 years old or another family member in your house with a disability.

What does the state of Kansas consider low income? That answer depends on how many people are in your household. Here's a quick breakdown of what qualifies as low income (annually) for each household size:

| Size of Household | Max Income Eligibility Limit |

|---|---|

| 1 | $19,392 |

| 2 | $26,228 |

| 3 | $33,064 |

| 4 | $39,900 |

| 5 | $46,737 |

| 6 | $53,573 |

| 7 | $60,409 |

| 8 | $67,245 |

If you have more than eight people living in your house, add $6,836 per person to get the maximum income eligible for Medicaid. For example, if you have nine people in your household, add $6,836 to $67,245, which gives you a minimum household income of $74,081.

The KanCare card is your proof of coverage and contains all of the basic information about your KanCare plan, such as your MCO, name, and KanCare number. KanCare Clearinghouse will send you your card after approving your application.

The processing period for your KanCare application will vary based on the type of application you submitted (i.e., your eligibility type). For example, most applications have a processing time period of 45 days. However, if you claim a disability on your application and the Social Security Administration has yet to approve or deny your application, it could be 90 days until you hear a response from KanCare.

During this waiting period, you should keep an eye out for any mail from KanCare Clearinghouse, as it's common for the program to request additional information. If you miss any deadlines, the state's Medicaid program can deny your application, so be extra diligent about this.

When KanCare does either approve or deny your application, you will receive a letter in the mail notifying you of the decision. If KanCare denies your application, you have the right to file an appeal and explain why you disagree with the decision.

Prior to 2020, you had to renew your KanCare membership every year in order to maintain access to benefits, but the COVID-19 pandemic has changed things. Since the pandemic, KanCare has not required enrollees to renew their memberships. Instead, members were able to maintain their membership without having to submit annual renewal paperwork.

However, new legislation has led to the "unwinding process," which requires state Medicaid programs to start renewals again. Starting on April 1, 2023, each state has 12 months to start Medicaid reviews and redetermine the eligibility of its enrollees, so how do you renew your KanCare card?

When your renewal period comes, KanCare will send you a notice in the mail. The best way to maintain your coverage and avoid complications is to complete your renewal papers and submit them as soon as possible. You can either mail your renewal application in or submit it online.

Did you lose your KanCare card? You can call KanCare Clearinghouse directly or your MCO (Sunflower, United Healthcare, or Aetna) to get a replacement.

This state program covers several essential medical services ranging from routine doctor's visits to heart and lung transplants. However, since KanCare is a managed care program, you must enroll in one of these three plans to receive benefits:

While all three provide the same mental, physical, and substance abuse healthcare services, you can take advantage of different extra services and coverage depending on your chosen plan.

KanCare provides coverage for pediatric and adult dentistry services. As an adult enrolled in KanCare, you can receive coverage for certain restorative dental treatments, periodontal care, and silver diamine fluoride treatments.

Your dental benefits depend on the MCO you enroll with. Here is what you can expect from each provider regarding dental coverage:

In addition to the above benefits, you may be able to receive full or partial coverage for dentures. For example, with Aetna, you can get a full set of dentures every five years if you are a member of the intellectual/development disability (I/DD), frail elderly (FE), or physical disability (PD) waiver programs. For those who anticipate requiring more visits to the dentists, investing in private dental plans in Kansas is advisable.

KanCare members have access to several Kansas drug assistance programs, many of which have no costs:

KanCare coverage extends well beyond typical health insurance to give you various extended health care benefits. From transportation to your doctor's appointments to vision care, you can enjoy more well-rounded health care coverage through KanCare. However, since Kansas Medicaid operates on a managed care structure, the exact extended benefits you'll get to enjoy vary depending on the plan provider you enroll with.

For example, the Aetna Better Health of Kansas plan offers a wide range of additional services, including behavioral health services, pharmacy benefits, and chronic disease management. With this same plan, you can also visit an in-network eye doctor without needing a referral.

With the Sunflower Health Plan, you can receive one pair of glasses and one eye exam every year in addition to behavioral health services and gas reimbursement for transportation to medical appointments. You can also save even more money by participating in the My Health Pays® Kansas Medicaid Rewards program.

The United Healthcare Community Plan also covers vision care in addition to kidney disease care, asthma and COPD support, and diabetic support. The United Healthcare Community Plan also helps cover the costs of essential medical or safety equipment that you need to stay healthy at home.

The benefits above are just a few of the many services each provider covers. If you enroll in KanCare, you can gain access to multiple extended healthcare benefits that help cover a wide range of medical costs, regardless of which MCO you enroll with. While these programs help to cover the costs of necessary medical equipment, transportation and appointments, they do very little for income replacement. Shielding your household against income loss in the event of health-related problems can be explored through disability insurance.

If you plan on traveling or being out of Kansas for some time, it will be difficult to schedule any routine health appointments. KanCare managed care organizations typically do not cover any routine services outside of their network or the local area. However, if you are out of state and need to schedule an appointment, you can contact your MCO provider and try to get authorization for out-of-network coverage, but this is never a guarantee.

The only exception is emergency situations. If you need emergency medical care, find the closest hospital to you and let your insurance provider know. In this situation, you don't need to worry about getting pre-approval for out-of-network coverage. While KanCare does a great job of providing emergency coverage out of state, it certainly won’t pay for out of country emergency care. If you are traveling outside of the United States for leisure, invest in proper travelers insurance.

KanCare does not have special coverage options for students, but students are welcome to apply as long as they satisfy Medicaid eligibility requirements.

Being over the age of 65 is one of the requirements you can meet to qualify for KanCare. Fortunately, this program also offers some long-term care coverage, but you must meet additional eligibility requirements.

For example, you may be eligible for nursing facility coverage through KanCare if your assets are worth less than $2,000; in this case, the home does not count if you want to return to your house.

Some people try selling or giving away their assets to lower their asset value and qualify for this benefit, but this does more harm than good. When you apply for KanCare, it looks at the last five years, so you could face penalties for selling or gifting assets in an attempt to qualify for coverage.

Seniors can also take advantage of the program's home and community-based services (HCBS) benefit. Similar to the nursing facility coverage, you must have assets worth less than $2,000 if you're single and have special medical needs.

Finally, adults who are 55 years or older can apply for PACE (Program of All-Inclusive Care for the Elderly). This managed care program provides coverage for long-term care, but it only covers the medical expenses of in-network providers.

As comprehensive as KanCare is, it doesn't cover everything. Understanding what the state's Medicaid program doesn't cover is essential before enrolling. For example, KanCare does not cover the following services and procedures:

For funerals, burial assistance may be offered by the State of Illinois to individuals who qualify under specific Medicaid categories. Considering the rising cost of burial and related fees in Kansas, ensure that your family is secured with comprehensive funeral insurance.

For a more complete list of services that KanCare doesn't cover, you can call your plan provider (the managed care organization in charge of your coverage) to learn more.

KanCare clearly covers a lot, but there are also several services that it doesn't cover, which can lead to some confusion. Here is a breakdown of the major services and treatments you can receive as a KanCare enrollee.

| Dental | |

|---|---|

| X-Rays | Yes |

| Exams | Yes |

| Wisdom Teeth | Yes, for wisdom teeth removal surgery |

| Vision | Whether you enroll with Sunflower, United Healthcare, or Aetna, KanCare provides coverage for: |

|---|---|

| Eye Exams | Yes |

| Glasses | Yes |

| Laser Eye Surgery | Yes |

| Surgery | |

|---|---|

| Rhinoplasty | KanCare does not cover cosmetic procedures, it does help pay for medically necessary surgeries. |

| Breast Reduction | KanCare does not cover cosmetic procedures, it does help pay for medically necessary surgeries. |

| Hospital | |

|---|---|

| Hospital stays | Yes |

| Ambulance transportation | Yes |

| Giving birth | Yes |

| Sexual Health | |

|---|---|

| Gynecologist visits | Yes |

| Erectile Dysfunction | No |

| Birth Control | Yes |

| Fertility Treatment | No |

| Specialist Services | It's important to remember that while KanCare does cover the following services, you will still rely on your managed care organization to receive coverage. Since each MCO is its own entity, each one may have different coverage limits. |

|---|---|

| Podiatry and Foot Care | Yes |

| Allergy Testing | Yes |

| Sleep Physician Services and CPAP Machines | Yes |

Kansas Medicaid can be highly beneficial for those who qualify. By partnering with Sunflower, United Healthcare, and Aetna, KanCare gives you the opportunity to receive well-rounded healthcare coverage for little to no costs.

In addition to basic health care services, Kanasas Medicaid also covers several additional services ranging from vision to family planning and even transportation to doctor's appointments, but the primary challenge that Kansas residents face is simply qualifying for Kansas Medicaid.

With strict eligibility and income requirements, the state's Medicaid program makes it difficult for people to receive these low-cost healthcare services. Plus, now that the "unwinding" process is in effect, people will have to start renewing their memberships again, only for many to find out that they no longer qualify.

If you don't qualify for Kansas Medicaid and want to find affordable health insurance options, you're not alone. At Insurdinary, we believe that everyone deserves affordable coverage without having to jump through hoops. If you've found yourself stuck between not qualifying for Kansas Medicaid and not finding other affordable healthcare options, don't lose hope. We at Insurdinary understand that deciding the best type of medical coverage can be a daunting task. Other types of private insurance, such as life insurance, can help pay for medical costs Medicaid will not cover, especially in the event of your passing.

Our insurance experts know how frustrating it is to find and compare policies that have a healthy balance of coverage and affordable premiums. That's why we take the time to get to know your needs and help you find the perfect policy. Simply fill out our online form with some information about you, and compare policies from leading providers that offer the coverage you need.

Insurdinary, and its network of partners offer many different types of insurance. In addition to health, dental, disability, life, funeral and travel insurance as discussed on this page, you may also be interested to explore the following: