MENUMENU

For the thousands of Delaware residents and families struggling to make ends meet, paying for health insurance can seem virtually impossible. Fortunately, the Delaware Medicaid DHSS (Department of Health and Social Services) plan provides affordable healthcare coverage and benefits for eligible low-income applicants.

While Medicaid covers basic healthcare expenses and medical bills, it's not all-inclusive. To prevent shouldering the debt of unexpected medical expenses, many Delaware residents extend their Medicaid coverage to include a more comprehensive range of benefits and services by way of private health insurance.

On this page, you'll learn all about Delaware's state Medicaid DHSS plan, including a comprehensive overview, eligibility requirements, how to enroll, coverage levels, qualifying medical services and procedures, and more. Once you have a fundamental understanding of how state Medicaid insurance works in Delaware, you can navigate the enrollment process with confidence and find the perfect plan for your coverage needs.

Delaware's Medicaid DHSS plan (which stands for Delaware Health and Social Services) is a health insurance plan for low-income families and individuals who meet the eligibility requirements. The Medicaid DHSS plan offers free or low-cost healthcare coverage to needy persons, with varying levels of benefits and covered services. In Delaware, the Division of Medicaid & Medical Assistance (DMMA) runs the Medicaid program with funds from both Federal and State tax money.

The services and benefits of what DHSS covers vary, but primary services include:

Most Medicaid recipients in Delaware receive their healthcare benefits under a Managed Care Organization (MCO), which ensures quality and cost-effective medical care. However, there are some exceptions, mainly for people in Long-Term Care Medicaid programs. While Delaware allows you to choose the MCO plan that will work best with your family, most people receive mandatory enrollment into the Diamond State Health Plan (DSHP). In addition, Delaware has two state-contracted managed care organizations in its health exchange network, which include:

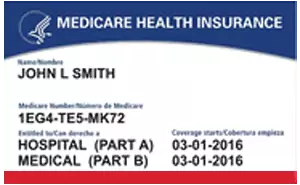

Once you enroll in Delaware's Medicaid DHSS program, you'll receive a packet with information about your options regarding managed care organizations. You can choose any plan that best fits your needs. Once you select a plan to enroll in, you will receive a card from that MCO, which is your Medicaid ID card. It will contain your name and unique ID number for your Medicaid enrollment. You must provide your Medicaid card to any healthcare provider, pharmacy, or transportation provider to receive those covered services.

Delaware offers several options for residents to apply for its DHSS Medicaid program: in-person, over the phone, through the mail, or online.

In-Person: You can apply for Medicaid in-person by visiting the Division of Social Services (DSS), where a staff member will guide you through the enrollment process. Call (866) 843-7212 to find the address of the DSS office closest to your location.

Over the Phone: Call (800) 372-2022 or (302) 255-9500 to speak with a Medicaid Customer Relations agent, who will direct you to the closest Division of Social Services office. After you speak with staff regarding your Medicaid eligibility, you'll receive a packet in the mail containing the Medicaid application form and other important information. Complete the form, sign and date it, then mail it back to the address on the application form.

Through the Mail: You can download and print out the Medicaid application form online. Once you complete and sign the application, mail it to the address provided.

Online: Perhaps the most convenient way to apply for Delaware DHSS Medicaid is online through the ASSIST website. It has an eligibility screening tool you can use to check if you qualify for Medicaid. Then, you can apply for your benefits online with the ASSIST tool. At the end of your application, you'll see a web page explaining the documents you'll need to send through the mail to verify your eligibility.

To enroll in the Delaware DHSS Medicaid plan, you'll need to meet specific eligibility requirements, including the two basic qualifications regarding income and citizenship/residency:

| Qualification | Details |

|---|---|

| Income | Medicaid provides free and low-cost health insurance to low-income individuals and households. Income eligibility depends on your family size and whether you make less than the Federal Poverty Level (FPL) limits. In most cases, you'll likely qualify if your income is at or below the 100% Federal Poverty Level (depending on your household size). The income limit for pregnant women and infants under one is at or below 200% of the FPL, and children age one to six can qualify with an income limit at or below 133% of the FPL. For more details, here's a table of income limits for eligibility in Medicaid and other DMMA programs in Delaware. |

| Citizenship/Residency |

Medicaid-eligible individuals must be a resident of Delaware and a U.S. citizen or a legally residential noncitizen. Non-citizens include DACA recipients, although both legal and illegally residing citizens may be able to receive coverage for certain medical emergencies and services for labor and delivery depending on their income level. Additional eligibility qualifications include:

|

As we said, you can apply for DHSS Medicaid in-person, over the phone, through the mail, or online. Once you complete the application, Delaware DSS may be able to verify your eligibility information electronically. However, if that's not the case, you may have to provide physical copies of the following:

If you are eligible for Medicaid, you'll receive a packet of information in the mail about how to choose the right plan from Delaware's managed care organizations: Highmark Health Options and AmeriHealth Caritas.

You can begin the application process right now online by visiting the ASSIST enrollment website. Furthermore, you can find out more information about Delaware's managed care organizations by visiting the website for Highmark Health Options (Blue Cross Blue Shield Delaware) and AmeriHealth Caritas (Diamond State Health Plan), where you can enroll, check your benefits, report changes, and more. Or, call (800) 996-9969 to contact a Medicaid Health Benefits Manager for guidance on MCO enrollment, benefits, and prescription coverage.

Once you have your Delaware DHSS Medicaid card, you'll need to bring it with you to verify your enrollment and receive your medical benefits. How can you renew your DHSS Medicaid benefits or replace a lost, damaged, or stolen Medicaid card?

Medicaid renewal has been automatic since the onset of the COVID-19 pandemic. However, the Consolidated Appropriations Act of 2023 is changing that. As of April 1st, 2023, Delaware Medicaid recipients must manually renew their enrollment and benefits. If you're already a Medicaid recipient, you'll receive a pre-filled renewal form in the mail for every eligible household member with accompanying case information.

Once you review your form, you'll confirm the information it contains or report any changes, then send it back to renew your enrollment through the mail, in-person at a DSS office, or by fax. Alternatively, you can find the renewal form online through the Delaware ASSIST website.

If your DHSS Medicaid ID card was lost, stolen, or damaged, you can apply for a replacement over the phone. Call the Delaware Medicaid Customer Relations office at 1(866) 842-7212 or 1(302) 571-4900. Here's another web page with contact numbers for Delaware's DMMA programs and DSS offices.

What does Delaware DHSS Medicaid cover? The primary benefits and services you'll receive as a Delaware Medicaid recipient include the following:

While Delaware's DHSS Medicaid health insurance offers dental care coverage for children up to the age of 20. Some coverage is automatic; other services require prior authorization. The benefits included with your DHSS Medicaid coverage include:

For those who have more serious dental issues and anticipate requiring more visits to the dentists, investing in private dental plans in Delaware is advisable.

DHSS Medicaid Formulary offers different coverage levels for prescription drugs. It also has varying levels of co-payments, although you'll never pay more than $15.00 in one month. Of course, your specific prescription drug benefits will vary based on the MCO plan you choose.

For a quick example, AmeriHealth Caritas will:

If you are a recipient of both Medicaid and Medicare, your Medicare plan will provide your drug coverage benefits. If that's the case, consider purchasing a Medicare Advantage Plan or Part D plan.

Delaware Prescription Assistance Program (DPAP): For people receiving Social Security Disability benefits or those over the age of 65, you may be eligible for DPAP. However, you must also have an income at or below 200% of the FPL and have prescription medications that cost more than 40% of your yearly income. It provides you with up to $3,000 annually towards either Medicare Part D premiums or medically necessary prescription drugs. You'll have a co-pay of 25% of your prescription or $5, whatever is more. Learn more about DPAP on the DHSS website or enroll in DPAP using this form.

For many people enrolled in Delware's DHSS Medicaid insurance and MCO plan, their coverage isn't sufficient for your unique medical needs. Investing in quality disability insurance is an excellent way to assist with some of the costs incurred with not being able to work either temporarily or permanently, and to help with the cost of medical needs.

If that’s the case, you can opt for extended healthcare coverage through private insurance companies. For example, you could choose a health insurance plan that covers certain benefits and services that Medicaid does not cover. At Insurdinary, we offer extended healthcare plans for Medicaid beneficiaries with coverage gaps. Our services are free, and we help Delaware residents and Americans find affordable healthcare coverage that can provide benefits that Medicaid doesn’t offer.

Does Delaware DHSS Medicaid offer travel and out-of-state coverage benefits? In certain situations, yes. While coverage is dependent on the specific type of Medicaid or MCO plan you have, Delaware must provide coverage under certain circumstances, including:

In addition, Delaware Medicaid covers transportation services for medical needs, including ambulance services (when medically necessary) and general transportation services for medical and doctor appointments. If you are traveling outside of Delaware for leisure, invest in proper travelers insurance.

If you're a student in Delaware and you meet the income and eligibility requirements for Medicaid, you can receive coverage – remember, only state residents can enroll. Minors can remain under their parent's plan until they age out. In addition, certain colleges and universities in Delaware require students to have health insurance coverage.

Medicaid recipients in Delaware can enroll in long-term care (LTC) services from DMMA if they meet the financial and medical eligibility requirements. The long-term care managed care program in Delaware is the Diamond State Health Plan Plus (DSHP Plus). It consists of two primary programs: The Long-Term Care Community Services and The Nursing Facility Program.

The complete list of long-term care Medicaid programs includes:

Medicaid in Delaware does cover a wide range of benefits. However, there are certain healthcare services that it does not cover, including:

As benefits and Medicaid-covered services vary widely, there's much confusion regarding coverage in Delaware. If you’re planning on enrolling in Delaware’s DHSS Medicaid plans, it’s important that you know exactly what kind of coverage you can receive for certain services. Below is a breakdown of the most common Medicaid procedures and coverage eligibility:

| Dental Services (Age 20 and under) | |

|---|---|

| X-Rays and Exams | Yes (X-rays up to 4 times per year and Exams 2 times per year) |

| Wisdom Teeth | Yes |

| Vision | |

|---|---|

| Eye Exams | Yes (once per year) |

| Glasses | Yes (once per year) |

| Laser Eye Surgery | No |

| Surgery | |

|---|---|

| Rhinoplasty | Yes, if medically necessary (no cosmetic coverage) |

| Breast Reduction | Yes, if medically necessary (no cosmetic coverage) |

| Hospital | |

|---|---|

| Hospital stays | Yes |

| Ambulance transportation | Yes |

| Giving birth | Yes |

| End of Life Care | Hospice care services and most end of life drugs are paid for by DHSS. It is always wise to ensure that in the event of your passing, your family is secured with comprehensive funeral insurance. |

| Therapy and Counseling | |

|---|---|

| Physical and Occupational Therapy | Yes |

| Mental and Behavioral Health | Yes |

| Sexual Health | |

|---|---|

| Gynecologist visits | Yes |

| Erectile Dysfunction | Only pharmaceuticals |

| Birth Control | Yes |

| Fertility Treatment | No |

| Specialist Services | |

|---|---|

| Dermatology | Yes |

| Physiotherapy | Yes |

| Massage Therapy | No |

| Podiatry and Foot Care | Only surgical procedures and lab tests |

| Allergy Testing | Yes, for recipients who meet eligibility criteria |

| Sleep Physician Services and CPAP Machines | Yes, if medically necessary |

As we stated earlier, Medicaid often leaves coverage gaps for individuals with unique or special healthcare needs. The two primary MCOs – AmeriHealth Caritas and Highmark Health Options – have different coverage levels as well. If you feel that you may need more healthcare coverage than what Delaware's Medicaid provides, you may want to consider opting for extended coverage through a private or third-party insurance company. Other types of private insurance, such as life insurance, can help pay for medical costs Medicaid will not cover, especially in the event of your passing.

At Insurdinary, we believe that every American should have access to affordable health insurance. Although Medicaid's plans are either free or low-cost, they may not provide access to the specific benefits you or your family members need. It's simple: just head to our website, fill out a form, and then compare quotes from the leading insurance providers in the U.S. Once you have a list of quotes, you can browse through and pick the insurance plan that works best for your needs. After that, you can apply online in minutes. Our services are fast, straightforward, and free!

Insurdinary, and its network of partners offer many different types of insurance. In addition to health, dental, disability, life, funeral and travel insurance as discussed on this page, you may also be interested to explore the following: