MENUMENU

Are you eligible for Hawaii’s Med-QUEST and Medicaid health insurance plans? On this page, you’ll learn everything you need to know about basic coverage options, eligibility requirements, how to apply, and what it doesn’t cover. Understanding the most important aspects of Med-QUEST and what it covers is essential to ensure you pick the right plan and benefits for your unique health needs.

For some recipients, Medicaid doesn’t offer enough coverage and benefits. If your Med-QUEST plan has gaps, you can opt for extended health care coverage with third-party or private insurance companies. Insurdinary can optimize your coverage to include a more comprehensive range of benefits and services by way of private health insurance.

In doing so, you can gain additional benefits that can cover medically-related expenses and bills at an affordable price. For many, it’s the best option for eliminating coverage gaps that can lead to unexpected medical bills. Keep reading for all the answers to your questions about Hawaii Med-QUEST and Medicaid health insurance plans.

What Is Med-QUEST? Hawaii’s Med-QUEST Division (MQD) offers the Med-QUEST insurance program, which stands for Quality care, Universal access, Efficient utilization, Stabilizing costs, and Transforming health care to recipients. The Department of Human Services administers Medicaid services to eligible Hawaiians, including:

Originally, Med-QUEST was only fee-for-services (FFS). However, times have changed, and Med-QUEST is now a combination of FFS and managed care programs. In 2015, the QUEST Integration (QI) program combined several programs into one, including QUEST, QUEST-ACE, QExA, and QUEST-Net.

Hawaii Med-QUEST plans can be free or have low out-of-pocket costs. In addition, state and Federal tax money funds Hawaii’s Medicaid and Med-QUEST programs. The Children’s Health Insurance Program (CHIP), offers healthcare coverage to children who meet the eligibility criteria through both CHIP and Medicaid programs.

Currently, there are five different QUEST Integration programs that recipients can choose from:

While specific benefits vary by plan and individual eligibility, general services include:

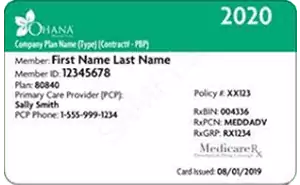

If you are eligible for enrollment in Hawaii Medicaid, you’ll receive a special ID card through the mail. Your ID card will be from the State of Hawaii Department of Human Services, and will contain your name, date of birth, and client number. If you live in a household with different members who are eligible, they will each receive their own unique card and ID number. You should also keep your card safe and avoid damaging the magnetic stripe on the back of the card. If there are any changes in your living situation or address, report them to your Medicaid caseworker within ten days.

*Please note that as there are multiple organizations supporting the medicaid efforts in Hawaii, your card may look different than the one shown above. This is an example of the ‘Ohana Health Plan card.

How can you apply for medical coverage with Hawaii’s Med-QUEST and Medicaid health plans? It’s easy. You can apply online, over the phone, through the mail, or by fax.

Online: One of the fastest ways to apply for Hawaii Med-QUEST and Medicaid health plans is by logging online and using the Med-QUEST Division Member Portal. Be sure to fill out the application as much as possible.

Over the Phone: You can complete the Medicaid application over the phone with help from a caseworker through the Med-QUEST Customer Service line. Call toll-free at 1(800) 316-8005. For TTY users, call toll-free at 1(855) 889-4325 or call 711.

By Mail or Fax: Another option you can use to apply for Hawaii Med-QUEST coverage is through the mail or by fax. You can fill out a PDF form, then print it out and mail it to the nearest Med-QUEST Division Eligibility Office.

Applying online is the easiest method, and you can also use a pre-screening tool on the online portal to determine if you’re eligible. Besides your application for QUEST Integration, you’ll probably have to supply the following documents:

Hawaii’s Medicaid and Med-QUEST health plans are only available to qualifying individuals and families. The quickest way to determine if you are eligible for Medicaid is by applying. However, there are general qualifications that applicants must meet. For example, you must be:

Individuals who also meet one or more of the following criteria are eligible if they are:

In terms of financial requirements, your total household income must meet the restrictions and be either at or under the Federal Poverty Level (FPL) criteria for each group:

If you meet the requirements for Hawaii Med-QUEST, you can apply online at this link.

One important note for applicants who have a disability or need long-term care services from Med-QUEST – more forms are necessary, including:

Disabled applicants

Long-term care applicants

After you complete the application and submit it, you’ll receive a packet in the mail within 45 days confirming your eligibility and automatic plan enrollment. It will contain information about the five available plans in HI and their benefits, so you can make an informed choice about which program will best meet your needs.

If you want to stay with your current plan enrollment, you don’t have to do anything. Be sure to choose the plan you want, because you can only change your coverage once within the first three months of your enrollment. Beyond that, you’ll have to wait for open enrollment to change again, which is from October 1st to 31st.

After you select a plan, you’ll receive your Med-QUEST ID card, which contains your name and unique client ID number. Even if you receive an unenrollment notice in the mail, you should keep your card, as you’ll need the same one should you become eligible again.

For pregnant women enrolled in a QUEST Integration plan when they deliver their child, their baby will have automatic enrollment within at least 30 days after they’re born. After the first month, parents can choose a new plan for their baby.

To learn more about the five available plans for Hawaii Medicaid, here’s a list of each provider with website links included:

How can you renew or replace your Med-QUEST Medicaid card in Hawaii? If your card is damaged, lost, or stolen, you can reach out to the Enrollment Call Center to order a new one by calling toll-free at 1(800) 316-8005.

Although you have already learned a little bit about open enrollment, which is from October 1st to 31st every year, there’s more information you need to know about enrolling in Hawaii Medicaid. In the last few years, Medicaid beneficiaries in Hawaii have experienced automatic enrollment in their health plans due to pandemic-related regulations.

However, that’s no longer going to be the case. Starting on April 1st, 2023, Hawaii will check eligibility coverage for every Medicaid beneficiary and end automatic enrollment, so you should begin updating your contact info and watch your mailbox. You’ll receive a pink envelope in April with more information about your eligibility.

So, what does Med-QUEST cover? The levels of Med-QUEST coverage depend on your unique circumstances and eligibility. Keep reading for more information about the basic covered services under Hawaii Medicaid QUEST Integration plans:

In Hawaii, Medicaid beneficiaries (adults and children) receive dental benefits. The Hawaii Dental Service (HDS) operates the dental benefits program with partner coordination from Community Case Management Corp (CCMC). It’s a fee-for-service (FFS) program, with benefits that depend mainly upon your age, as the majority are for children under the age of 21.

For covered adults, the only services available are emergency treatment for acute injuries of the teeth or supporting structures, including basic treatment and pain reduction.

With some limitations, Medicaid beneficiaries under the age of 21 will receive coverage for all medically necessary and preventative services, including treatments like:

For those who have more serious dental issues and anticipate requiring more visits to the dentists, investing in private dental plans in Hawaii is advisable.

Hawaii’s Med-QUEST Integration plans have a wide range of covered prescription drug plans with fee-for-service coverage. However, Hawaii’s Medicaid programs for prescription drugs are dependent upon a few different factors, including:

The following are a few examples of the many different types of drug coverage offered to Hawaiian Medicaid beneficiaries:

Here’s more information about the different levels of prescription coverage on the Med-QUEST website.

Certain QUEST Integration plan members may be eligible for additional coverage benefits, including:

Another option is getting additional coverage benefits from a private or third-party insurance company, which can help you cover medical expenses without breaking your budget.

Once you enroll in QUEST Integration, you can expect to receive some coverage for traveling and out-of-state medical care. You can obtain medically necessary care for off-island and out-of-state post-stabilization and emergency services. However, for any services that are off-island, out-of-state, or out-of-network and not an emergency, you’ll have to gain prior authorization. If you are traveling outside of Hawaii for leisure, invest in proper travelers insurance.

Unfortunately, Hawaii’s Medicaid doesn’t cover medical services in a foreign country.

Hawaii Medicaid covers eligible low-income individuals and families, including students. If you’re a state resident going to college or university in Hawaii, you’ll be able to receive health care coverage. If you’re going to another state for college, you will be subject to the same travel and out-of-state services guidelines.

Some seniors may be eligible for long-term care coverage through Hawaii’s Medicaid FFS program. Long-term care includes two different categories:

Institutional Services

Home and Community-Based Services

Eligible individuals must apply for these long-term care services and will only receive approval based on the required level of care and a doctor’s evaluation.

Hawaii’s QUEST Integration programs for Medicaid recipients include coverage benefits for specific subgroups, including:

However, there are certain limitations, the most common being illegibility due to citizenship status.

Of course, Medicaid does not offer comprehensive coverage. Some of the services that your QUEST Integration plan won’t cover include:

Although a small lump sum may be provided, the amount is small in comparison to the rising cost of funerals. Ensure that your family is secured with comprehensive funeral insurance.

The permanently or temporarily injured - Medicaid programs may provide some coverage for those who become injured or ill either in the short or long term. Depending on the nature of the injury or illness, it’s wise to explore disability insurance options to ensure no unnecessary out-of-pocket costs are incurred.

Determining the specific procedures and services that Hawaii Medicaid and QUEST Integration plans cover can be confusing. Here is a breakdown of basic coverage types and whether you can receive coverage under your Med-QUEST plan:

| Dental | |

|---|---|

| X-Rays and Exams | Yes |

| Wisdom Teeth Extraction | Yes, when medically necessary |

| Vision | |

|---|---|

| Eye Exams | Yes, every 12 months for 21 and under, every 24 months for 21 and over |

| Glasses | Yes, every 24 months (will replace lost, broken, and damaged glasses if it was beyond the beneficiary’s control) |

| Laser Eye Surgery | No |

| Surgery | |

|---|---|

| Rhinoplasty | No (unless medically necessary) |

| Breast Reduction | No (unless medically necessary) |

| Hospital | |

|---|---|

| Hospital stays | Yes |

| Ambulance transportation | Yes, for medical emergencies |

| Giving birth | Yes, including prenatal care, X-rays and lab tests, delivery, and post-partum care |

| Sexual Health | |

|---|---|

| Gynecologist visits | Yes |

| Erectile Dysfunction | No |

| Birth Control (Including IUD) | Yes |

| Fertility Treatment | No |

| Specialist Services | |

|---|---|

| Dermatology | Yes |

| Physiotherapy | Yes |

| Massage Therapy | Yes, when medically necessary |

| Podiatry and Foot Care | No routine care, only for diabetic treatments in a hospital or long-term care setting |

| Allergist and Allergy Testing | Yes, as preventative screenings |

| Sleep Physician Services and CPAP Machines | Only in hospital settings, and will cover CPAP when medical necessary |

While the Hawaii Med-QUEST Integration and Medicaid programs help provide free and low-cost health insurance and quality care services to eligible low-income individuals and families, it’s not all-inclusive. For many Hawaiian Medicaid residents, the coverage offered by this state- and federally-funded program is just not enough. With coverage gaps, you can end up responsible for unexpected medical expenses and bills, some of which can be in the thousands of dollars. Other types of private insurance, such as life insurance, can help pay for medical costs Medicaid will not cover, especially in the event of your passing.

Instead of just hoping that your Med-QUEST plan will provide enough Hawaii Medicaid coverage, your best bet may be to opt for additional healthcare coverage through a third-party or private insurance company. Here at Insurdinary, we can help. Our services are free and allow you to search and compare quotes from the nation’s leading insurance providers. Once you receive your quotes, you can customize the plan and coverage that fits you best.

Insurdinary, and its network of partners offer many different types of insurance. In addition to health, dental, disability, life, funeral and travel insurance as discussed on this page, you may also be interested to explore the following: