MENUMENU

Investing in an affordable healthcare plan is essential for your quality of life and happiness.

According to the Kaiser Family Foundation, around 10% of Indiana residents do not have insurance. Fortunately, you can access a reliable plan through Indiana Health Coverage Programs (IHCP). Indiana offers several programs you can choose from, according to your health history and budget limitations. Insurdinary can optimize your coverage to include a more comprehensive range of benefits and services by way of private health insurance.

In this article, you will learn how applying for IHCP benefits can reduce financial stress when seeking treatment for illnesses and injuries. Once you finish reading, explore Insurdinary to see how you can expand your healthcare coverage with the nation’s top providers.

Indiana Medicaid is a comprehensive healthcare plan that covers a wide range of preventive care, family planning, and emergency health services. The Healthy Indiana Plan (HIP) and Hoosier Healthwise Plan are just two popular Medicaid solutions you may choose if you earn a low income, are pregnant, or manage a disability. However, you can still access Indiana Health Coverage Programs if you are a non-disabled adult.

The FSSA Office of Medicaid Policy and Planning is a state-run agency that administers these insurance programs. The federal and state governments also regulate and fund Medicaid through their respective treasuries corresponding to the needs of residents. According to the Urban Institute, Indiana spends more on public welfare programs — like Medicaid — than any other budget sector.

You can enjoy numerous benefits when applying for Indiana Medicaid programs, including but not limited to the following:

Co-pays under these insurance plans should not cost you more than a few dollars, depending on the program you choose. Most IHCP programs will determine your premiums corresponding to the number of people living in your house. However, Indiana Medicaid does enforce a Maximum Income Limit for eligibility.

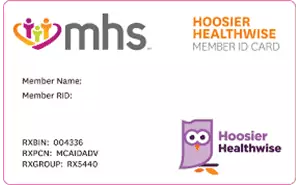

You will receive an Indiana Medicaid card, depending on the plan you choose. For example, MHS or Anthem may send you a copy of your Healthy Indiana Plan card via email or mail. This document will verify that you are an active member of an Indiana Medicaid program and provide information — such as a Medicaid ID number (MID) — that your healthcare provider can reference during billings.

It’s important to keep your card secure in a wallet or purse when leaving the house. This way, you can easily access your insurance contact information during emergencies.

You may not know how to apply for IHCP if this is your first time setting up your own insurance.

Before reimbursing your medical expenses, you must fill out an Indiana Application for Health Coverage form and submit it to your local Division of Family Resources office. Here are three ways you can complete this step:

You will need to include proof of your identity during the application process. Prepare to provide essential information, including:

Suppose the state or your insurance provider does not accept your application. In this case, you may be able to appeal by contacting the Family and Social Services Administration (FSSA).

You may qualify for IHCP such as Hoosier Healthwise, Healthy Indiana Plan, or Hoosier Care Connect if:

You may not qualify for traditional Medicaid programs if your income is too high. Regardless, you can still apply to specialized coverage plans that provide services like end-of-life care, emergency healthcare, and family planning.

You will receive a copy of your insurance card after the state receives and accepts your application. You can apply online for the fastest turnaround rate.

Issuers like MHS typically provide your card within five days of your membership confirmation. These usually arrive by mail.

You may also be able to request a digital copy of your card and MID number by contacting the issuer. This method is useful if you lose your card and must print another.

You might need to replace your Indiana Medicaid card if water stains, theft, and damage prevent your healthcare provider from reading the MID number. In this case, you can log in to your membership account and request a replacement online. New cards will typically arrive at your home within one to two weeks.

You must renew your Indiana Medicaid card once a year. Complete this task by revisiting the FSSA application portal and submitting your information.

You may need to update your address, income, or household information to qualify for renewal. Make sure your information is correct before the FSSA completes a redetermination assessment of your benefits. This way, you prevent unnecessary delays that may prevent you from accessing care when needed.

IHCP provides a wide range of coverage, depending on your needs. Currently, Indiana Medicaid offers two packages — A and C.

Package A includes Traditional Medicaid, Hoosier Healthwise, and Hoosier Care Connect plans. Package C is a Hoosier Healthwise plan that consists of some coverage limits.

Here are some of the benefits you can expect when becoming a member:

Enjoy full dental coverage — exams, preventive care, restoration services, etc. — under the Hoosier Healthwise, Hoosier Care Connect, and Traditional Medicaid package. However, you only have coverage for one exam and preventive care visit a year if you are 19 or older. For those who have more serious dental issues and anticipate requiring more visits to the dentists, investing in private dental plans in Indiana is advisable.

Both packages provide financial coverage for prescription drugs and refills. You can expect co-pays averaging around $3 for these services.

Indiana Medicaid also offers reimbursement for some over-the-counter medication.

Explore the preferred drug list under the Hoosier Healthwise plan for a comprehensive look at qualifying prescriptions.

Indiana Medicaid provides coverage for many healthcare services if you are 65 or older. Some of these benefits include long-term nursing home care and adult foster care services. You can also access non-clinical services if you have a disability and live at home.

The FSSA divides these benefits into three categories:

You can expect an asset limit of $2,000 if you are single and $3,000 if you are married. Income limits on all plans are generally between $1,200 and $2,800.

Out-of-state providers can participate in IHCP. Hence, you may be able to access coverage if you experience an emergency or illness outside of Indiana.

Don’t assume you have access to every resource. Each state has its own Medicaid policy, so certain exceptions apply.

You can contact the FSSA or your insurance provider if you aren’t sure about your healthcare options when traveling. If you are traveling outside of Illinois for leisure, invest in proper travelers insurance.

Indiana does not require you to have health insurance if you are a registered student. However, you can access benefits at little to no cost through IHCP. If you stay in the state for school, you will have the same benefits as adults when you enroll under these plans.

You can expect extensive healthcare coverage as a senior under some Indiana Medicaid programs. These benefits include in-house and community-assisted living care.

State and federal laws omit some subgroups from paying standard insurance fees during enrollment. Review the following if they apply to you:

You can apply to the Healthy Indiana Plan at no cost or contribution if you belong to a federally recognized Indigenous American tribe or are a native Alaskan. You can prove your identity by providing the following information upon registration:

You can contact the FSSA if you have questions about your eligibility as an Indigenous American or native Alaskan.

You may be eligible for IHCP if you are a current or former member of the U.S. Armed Forces, even if you already have coverage through the Military Health Services system or the TRICARE program.

Additionally, you can use both VA benefits and Indiana Medicaid benefits to pay for long-term care services. However, always consider IHCP eligibility requirements when seeking asset protection when applying for VA coverage. This method ensures that you can still apply for a Medicaid program later if you need it.

Enrolling in Indiana Medicaid can save you significant money on your medical treatments. Still, there are some procedures and expenses that IHCP will not cover. Here is what you may need to pay for out of pocket if you are a Medicaid member:

Burial assistance may be offered by the State of Indiana to individuals who qualify under specific Medicaid categories. The filing of claims on behalf of the deceased is limited to funeral homes and cemeteries, and these claims must be submitted within 90 days following the individual's passing. Considering the rising cost of burial and related fees, ensure that your family is secured with comprehensive funeral insurance.

Indiana Medicaid does provide some coverage for those who become injured or ill either in the short or long term. Depending on the nature of the injury or illness, it’s wise to explore disability insurance options to ensure no unnecessary out-of-pocket costs are incurred.

CareSource, Hoosier Healthwise, and HIP each provide a complete list of covered procedures on their respective websites. Contact your provider if you have questions about your coverage.

With so many programs under the umbrella of Indiana Medicaid, it may not be clear which treatments your insurance will accept. Fortunately, you don’t need to guess. Below is an outline of what IHCP covers:

| Dental | |

|---|---|

| X-Rays and Imaging | X-ray assessments are essential to a comprehensive dental exam. However, they can be costly out of pocket. Medicaid packages A and C cover X-ray services and related dental care methods needed for diagnoses. |

| Dental Examinations | You can enjoy a low or zero-dollar co-pay during your annual dental exam. Packages A and C also cover biannual examinations for your children. |

| Restorations | Indiana Medicaid covers restorative treatments like wisdom teeth removal, cavity fillings, and crowns. |

| Vision | |

|---|---|

| Visual Examinations | IHCP covers annual eye examinations if you are under 21. After you turn 21, you only have access to exam coverage once every two years. You may be able to negotiate coverage for frequent exams if you provide documentation of a medical diagnosis or an optometrist recommendation. |

| Glasses and Contacts | You can receive coverage for glasses once a year if you are under 21. If you are 21 or older, you only receive coverage once every five years. IHCP also reimburses contact lenses that are medically necessary if you have a facial deformity or allergy that prevents you from wearing glasses. |

| Eye Surgery | Indiana Medicaid covers ophthalmologic surgeries, including cataract surgery, corneal tissue transplants, and vitrectomies. |

| Surgery | |

|---|---|

| Anesthesia | Anesthesia may be a necessary treatment during your surgical procedure. IHCP will reimburse you for these services. Modified local anesthetics or changes to time units may not qualify for coverage. |

| Reconstructive Surgery |

You may receive coverage for breast reduction surgery under the following limitations:

IHCP does not cover reconstructive surgeries to improve congenital abnormalities or self-esteem. |

| Septoplasty | IHCP covers deviated septum surgeries if your condition restricts airflow. Coverage may also apply if your septum restoration is part of a cleft lip surgery. |

| Transplants | Indiana Medicaid will cover your organ transplants with prior authorization. This benefit includes the removal of transplants and out-of-state transplant procedures from specialized facilities not available in Indiana. |

| Implants | Indiana Medicaid will cover any auditory or pacemaker implants you need to improve your health and quality of life. Review this document for more information and limitations on these procedures. |

| Hospital | |

|---|---|

| Transportation | Packages A and C provide emergency transportation to the hospital. Only package A covers non-emergency transportation expenses if you schedule ahead. |

| Hospice Care | Package A will cover hospice care expenses. However, service limitations may apply depending on the length of your stay. Package C does not cover hospice. In the event of your passing, it is also important to note that Indiana Medicaid does not cover the cost of funerals. Investing in proper funeral insurance can alleviate financial burdens for your family. Considering the rising cost of burial and related fees in Indiana, ensure that your family is secured with comprehensive funeral insurance. |

| Exams, Wellness, and Clinical Services | IHCP covers most inpatient and outpatient hospital services. |

| Emergency Room Visits | Traditional Medicaid and Package C cover non-emergency use of the ER room with no co-pay. Hoosier Care Connect charges a $3 fee per visit. |

| Sexual Health | |

|---|---|

| Family Planning | Indiana Medicaid covers contraceptives if you are not pregnant. They also provide benefits for STD lab testing and counseling (including HIV). |

| Cancer Screenings | You may qualify for pap smears and breast cancer screening benefits under the Indiana Breast and Cervical Cancer Program. |

| Specialist Services | |

|---|---|

| Physical, Occupational, and Speech Services | If you live with a disability that restricts your movement or speech, you can seek treatment with Indiana Medicaid. However, these benefits only apply if a qualified physician, psychologist, or advanced practitioner refers you for treatment. |

| Foot Care | Package A provides coverage for regular foot examinations and treatments. You cannot access reimbursement under Package C. |

| Developmental Services | You or your child can seek affordable care from a specialist to manage developmental disorders. Several restrictions apply, such as providing proof that you received a diagnosis before your 22nd birthday. |

Indiana Medicaid can save you thousands of dollars on your routine medical treatments. However, it may not always be enough if you live with chronic or long-term conditions. Third-party insurance options may be able to fill the gaps that IHCP cannot. Other types of private insurance, such as life insurance, can help pay for medical costs Medicaid will not cover, especially in the event of your passing.

At Insurdinary, we help you explore dozens of legitimate insurance providers nationwide. Our website lets you compare and contrast premiums, reviews, and more. Get a quote to start shopping for insurance with a team you can trust.

Insurdinary, and its network of partners offer many different types of insurance. In addition to health, dental, disability, life, funeral and travel insurance as discussed on this page, you may also be interested to explore the following: